London, UK –

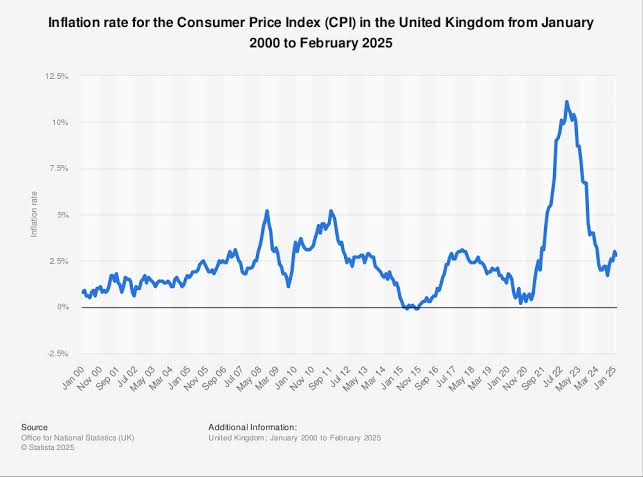

The UK’s inflation rate has fallen to 1.7%, below the Bank of England’s 2% target, sparking widespread speculation about potential interest rate cuts. This significant drop, driven by lower airfares and fuel prices, marks a notable moment in the UK’s battle against surging prices.

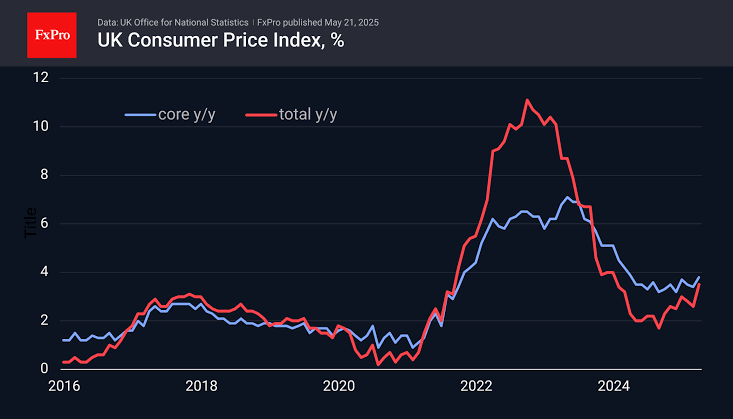

According to recent data, the Consumer Price Index (CPI) has dipped below the target, partially offset by rising food and non-alcoholic beverage costs. Services inflation, although still relatively high, dropped sharply from 5.6% to 4.9%, further fueling speculation about rate cuts.

The Bank of England is expected to cut interest rates in response to the lower inflation figures. Economists predict another rate reduction at the Bank’s next Monetary Policy Committee (MPC) meeting on November 7. Potential rate cuts could support Chancellor Rachel Reeves’ plans to close a £40 billion fiscal gap.

The drop in inflation could have significant implications for benefit payments, with smaller increases expected next year. However, the state pension is still expected to rise by £460 due to strong wage growth.

Mortgage holders and savers are also likely to be affected, with further interest rate cuts potentially leading to cheaper mortgages and lower savings rates. Some providers have already started pulling top savings deals in anticipation of rate cuts.

The MPC remains divided over the persistence of inflationary pressures, with Governor Andrew Bailey and Chief Economist Huw Pill holding different views on the pace of rate cuts. This division may influence the timing and speed of future rate reductions.

As the UK navigates its economic challenges, the potential for interest rate cuts offers a glimmer of hope for borrowers and businesses. However, savers may need to adjust their expectations.

With the economic landscape evolving, one thing is certain – the UK’s inflation rate has opened the door to potential interest rate cuts, and the consequences will be closely watched by economists, policymakers, and the public alike.

UK Inflation Drops Below Target, Paving Way for Potential Interest Rate Cuts

The UK’s inflation rate has dipped to 1.7%, below the Bank of England’s 2% target, sparking speculation about potential interest rate cuts. This significant drop, driven by lower airfares and fuel prices, marks a notable moment in the UK’s battle against surging prices.

*Key Factors Influencing Inflation and Interest Rates*

– *Lower Airfares and Fuel Prices*: The primary drivers behind the recent decline in inflation, partially offset by rising food and non-alcoholic beverage costs.

– *Services Inflation*:

Although still relatively high, services inflation dropped sharply from 5.6% to 4.9% in September, further fueling speculation about rate cuts.

– *Core Inflation*:

Declined from 3.6% to 3.2%, indicating a decrease in domestic cost pressures.

*Potential Impact on Interest Rates*

The Bank of England is expected to cut interest rates in response to the lower inflation figures. Economists predict another rate reduction at the Bank’s next Monetary Policy Committee (MPC) meeting on November 7. Potential rate cuts could support Chancellor Rachel Reeves’ plans to close a £40 billion fiscal gap.

*Economic Implications*

– *Benefit Payments*:

Lower inflation could result in smaller benefit payment increases, with the state pension still expected to rise by £460 next year due to strong wage growth.

– *Mortgages and Savings*: Further interest rate cuts could lead to cheaper mortgages and lower savings rates, with some providers already pulling top savings deals.

*Divisions within the MPC*

The committee remains divided over the persistence of inflationary pressures, with Governor Andrew Bailey and Chief Economist Huw Pill holding different views on the pace of rate cuts. This division may influence the timing and speed of future rate reductions.

*Forecasts and Predictions*

Economists at ING and Deutsche Bank predict further rate cuts, with some expecting a quarterly cadence of reductions. However, others, like Huw Pill, advocate for a more cautious approach, highlighting the need for careful consideration.