Platinum prices have surged to a four-year high, driven by a perfect storm of increased demand and tightening supply. The precious metal, often overshadowed by its more popular counterparts gold and silver, has seen its price skyrocket 24.82% over the past month and 26.48% compared to the same time last year.

The rally has been fueled by a combination of factors, including a surge in demand from the automotive industry, where platinum is used in catalytic converters to reduce emissions. As the global economy continues to recover from the pandemic, the demand for platinum in this sector has increased, driven by the growth in vehicle production and sales.

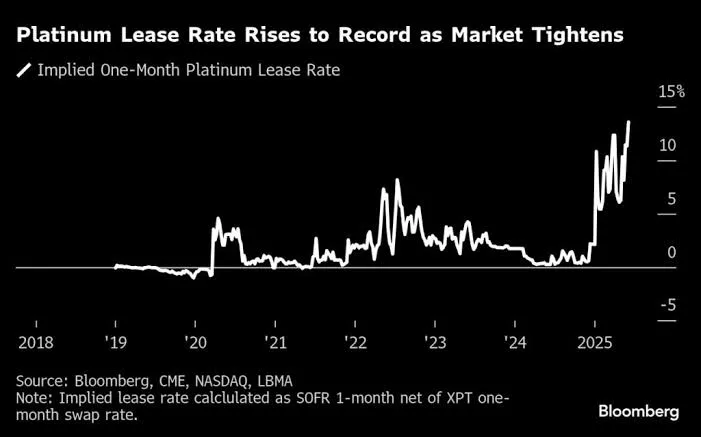

Another key factor contributing to the price increase is the tightening supply of platinum. South Africa, the world’s largest producer of platinum, has faced numerous challenges in recent years, including power shortages, labor disputes, and declining ore grades. These issues have resulted in reduced production levels, further exacerbating the supply-demand imbalance.

“The platinum market is facing a significant deficit, and we expect prices to remain strong in the coming months,” “The demand from the automotive industry is expected to continue growing, while supply constraints will likely persist, supporting higher prices.”

The price surge has also been driven by increased investment demand, as investors seek safe-haven assets amid global economic uncertainty. Platinum’s unique properties, including its rarity and industrial applications, make it an attractive option for investors looking to diversify their portfolios.

The four-year high in platinum prices has significant implications for various industries, including automotive, jewelry, and investment. As prices continue to soar, manufacturers and consumers may face increased costs, while investors may see opportunities for growth.

In related news, other precious metals have also seen price movements, with gold futures prices trending flat at $3,318 per ounce, while copper prices are trending lower at $4.8505.

*Current Price:* Platinum prices are currently trading at 1,214.50 USD 0.00 (0.00%), with analysts predicting further gains in the coming months.

*Market Outlook:* The platinum market is expected to remain strong, driven by increased demand and supply constraints. Investors and manufacturers will be closely watching the market, looking for opportunities and managing risks.

*Key Drivers:*

– Increased demand from the automotive industry

– Tightening supply due to production challenges in South Africa

– Growing investment demand amid global economic uncertainty

*Impact:*

– Higher prices may lead to increased costs for manufacturers and consumers

– Investors may see opportunities for growth in the platinum market

– The price surge may have implications for other precious metals and commodities

Stay tuned for further updates on the platinum market and other economic news.